Problem 1

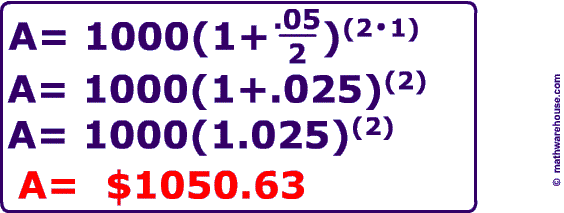

If you have a bank account whose principal = $1,000, and your bank compounds the interest twice a year at an interest rate of 5%, how much money do you have in your account at the year's end?

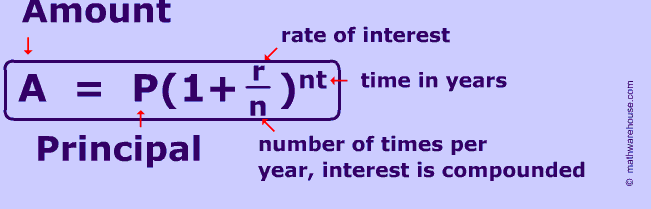

Formula for Compound Interest

Compound interest is a great thing when you are earning it! Compound interest is when a bank pays interest on both the principal (the original amount of money)and the interest an account has already earned.

To calculate compound interest use the formula below. In the formula, A represents the final amount in the account after t years compounded 'n' times at interest rate 'r' with starting amount 'p' .

This page focuses on understanding the formula for compound interest ; if you're interested in taking a deeper dive into how compound interest works and exploring some real world examples, please read our article here.

If you have a bank account whose principal = $1,000, and your bank compounds the interest twice a year at an interest rate of 5%, how much money do you have in your account at the year's end?

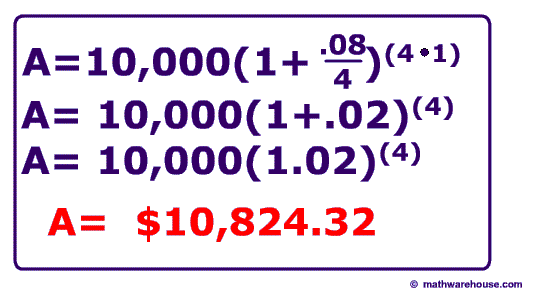

If you start a bank account with $10,000 and your bank compounds the interest quarterly at an interest rate of 8%, how much money do you have at the year's end? (assume that you do not add or withdraw any money from the account)

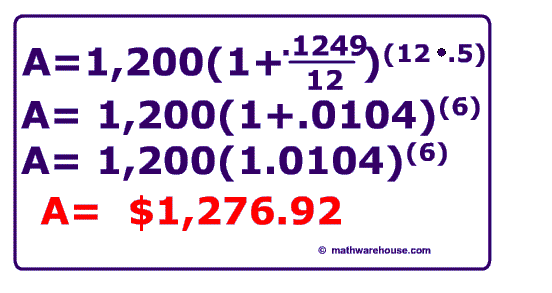

The first credit card that you got charges 12.49% interest to its customers and compounds that interest monthly. Within one day of getting your first credit card, you max out the credit limit by spending $1,200.00. If you do not buy anything else on the card and you do not make any payments, how much money would you owe the company after 6 months?

Note: since the duration of time is half of a year, the value of t is ½.

6 months is half of a year, and t in the compound interest formula is measured in years.You win the lottery and get $1,000,000. You decide that you want to invest all of the money in a savings account. However, your bank has two different plans.

Plan 1

The bank gives you a 6% interest rate and compounds the interest each month.

Plan 2

The bank gives you a 12% interest rate and compounds the interest every 2 months.

Question: In 5 years from now, which plan will provide you with more money.